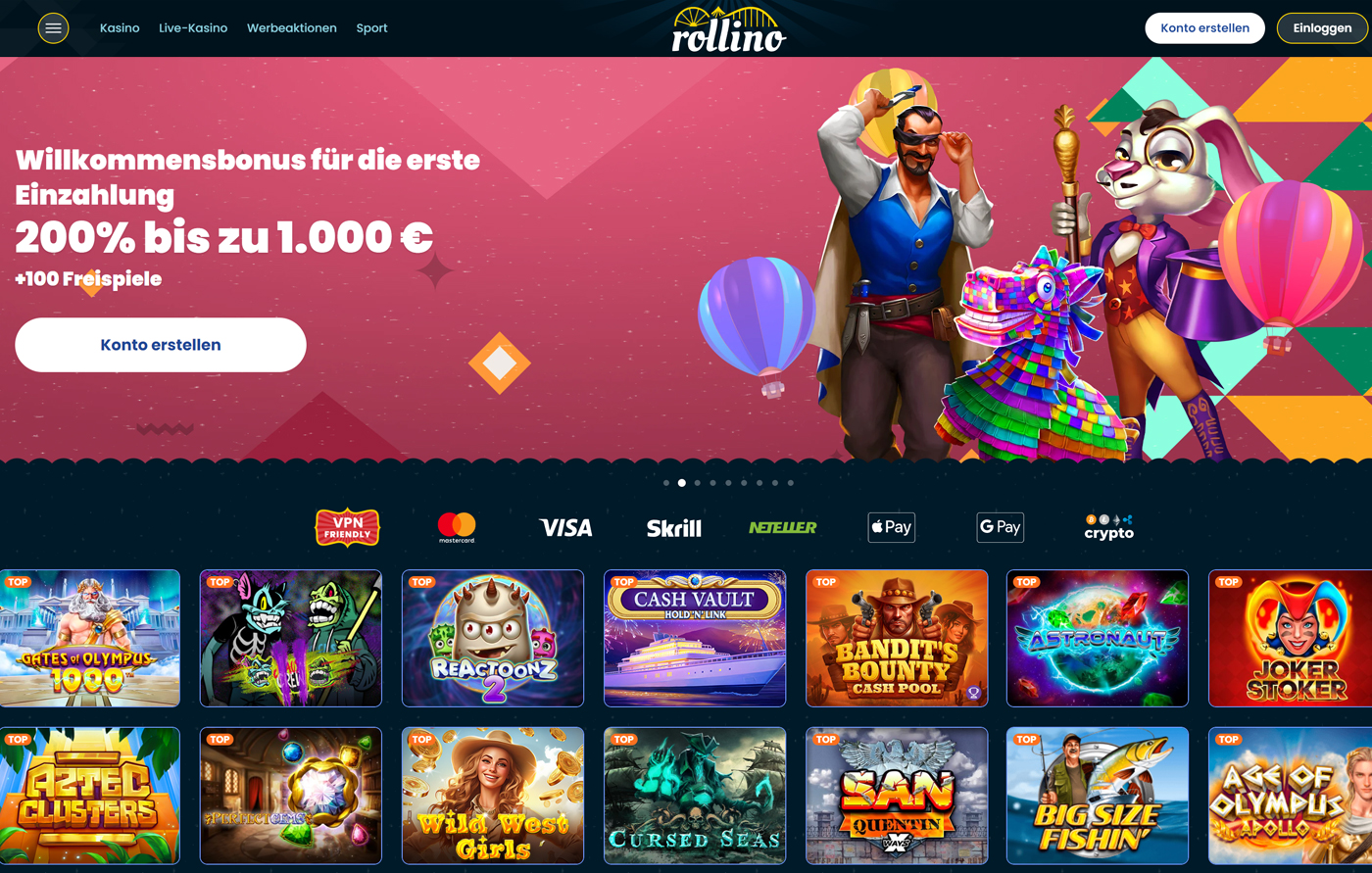

Das Rollino hat sich in der Glücksspielwelt einen Namen gemacht und lockt Spieler mit großzügigen Bonusangeboten, einer breiten…

Testberichte

Testberichte

Testberichte

Testberichte

Das Rollino hat sich in der Glücksspielwelt einen Namen gemacht und lockt Spieler mit großzügigen Bonusangeboten, einer breiten…

Testberichte

Testberichte

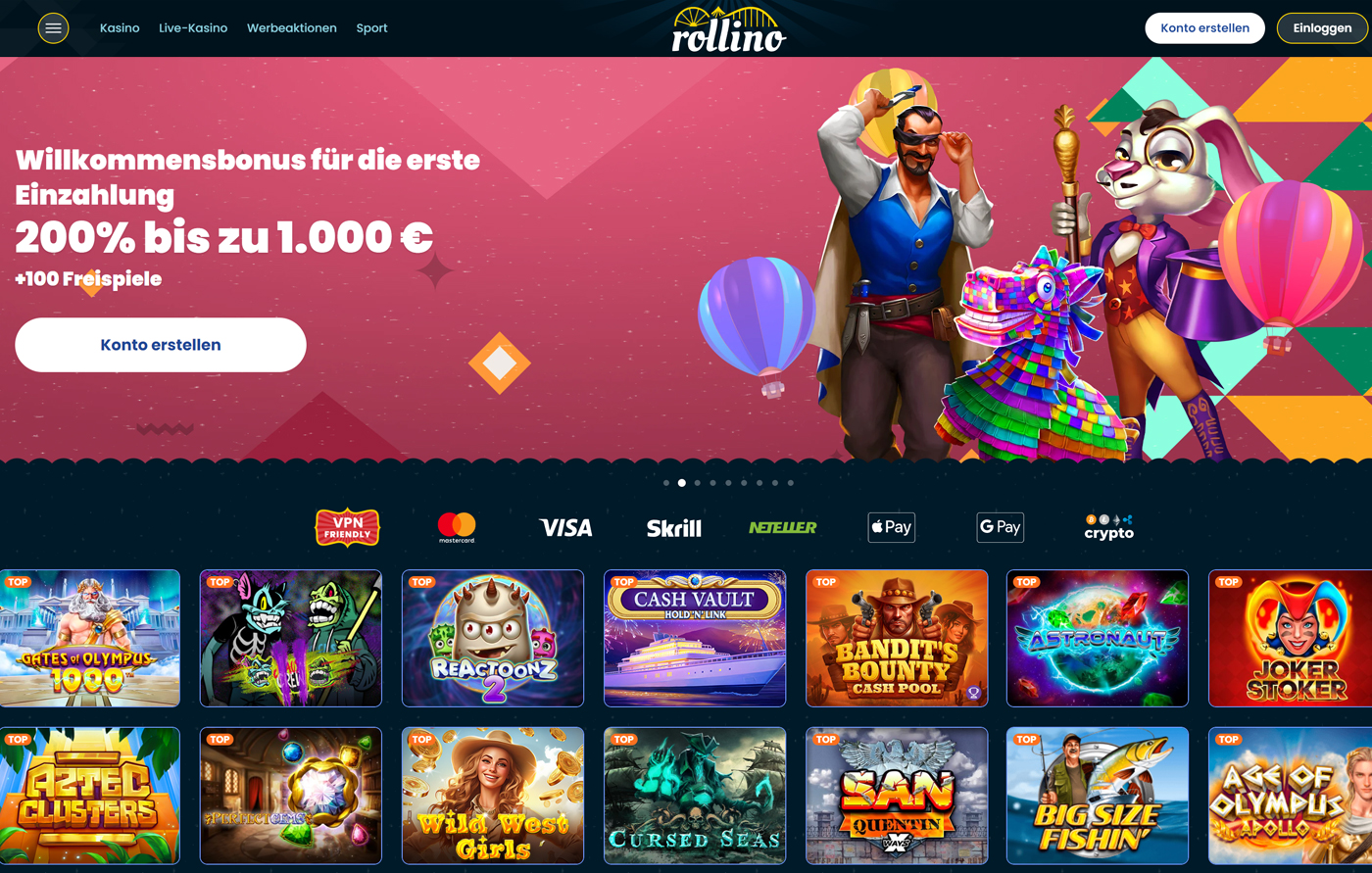

Der perfekte Sommer startet für viele Menschen mit Sonne, Strand und dem Rauschen des Meeres. Was darf nicht…

Testberichte

Testberichte

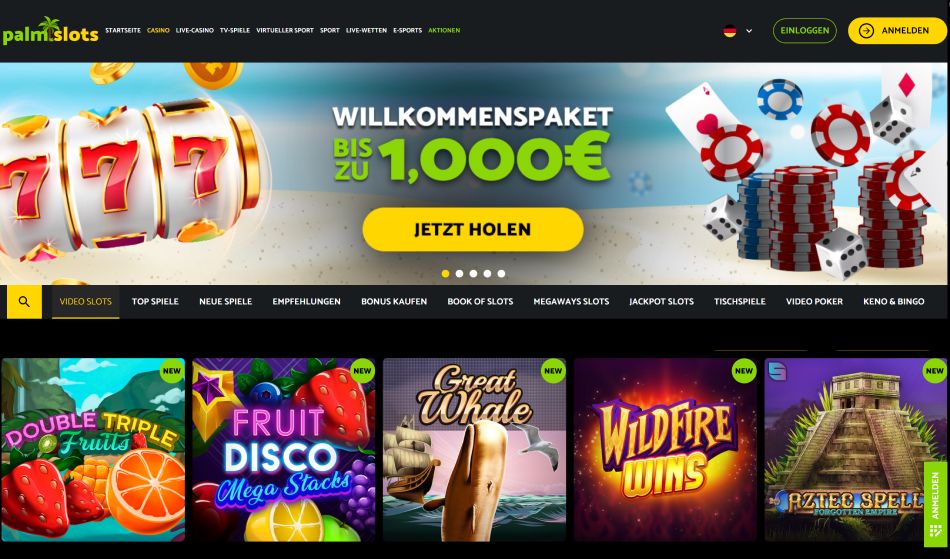

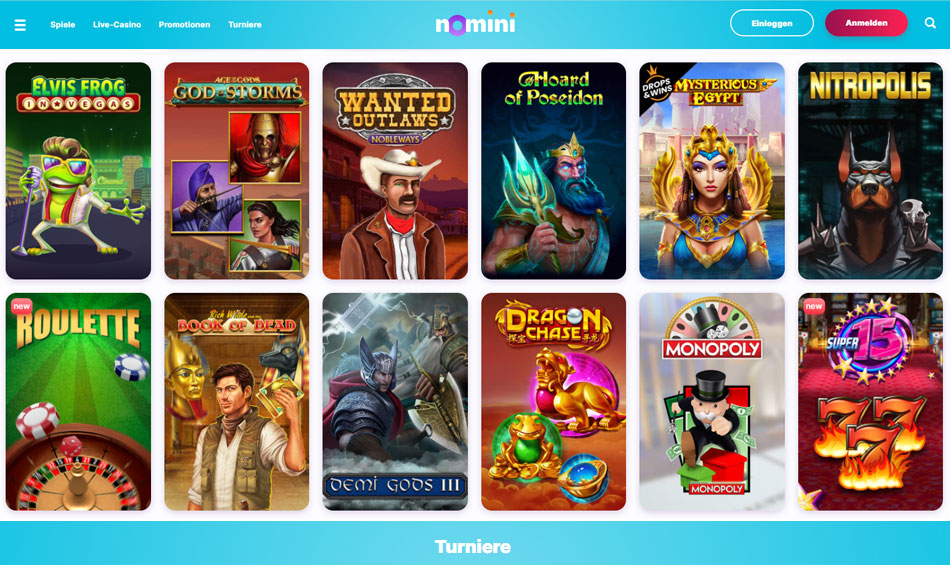

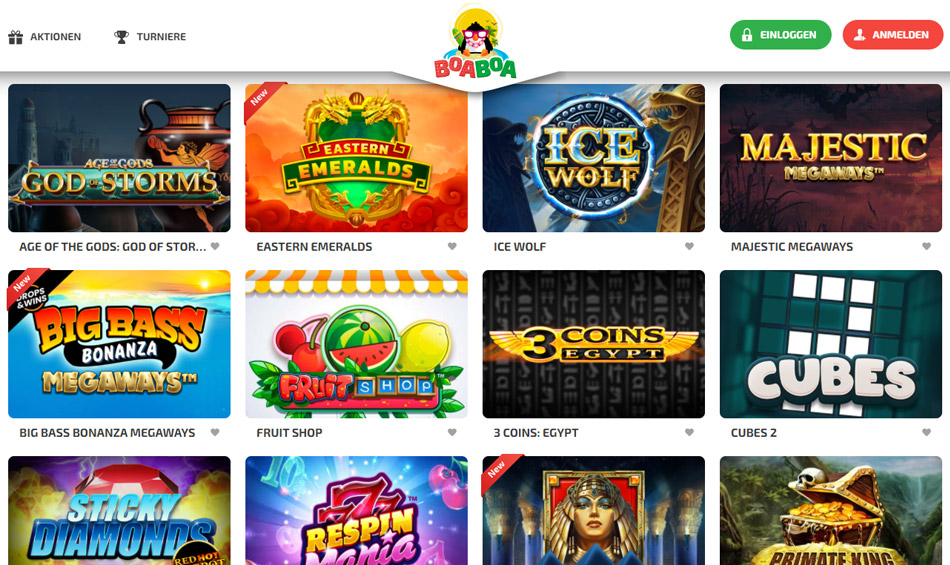

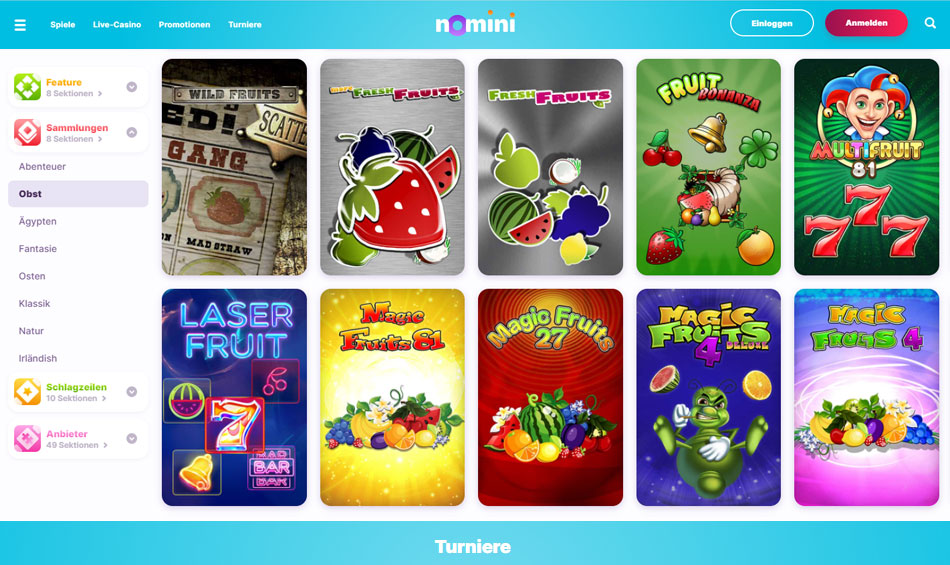

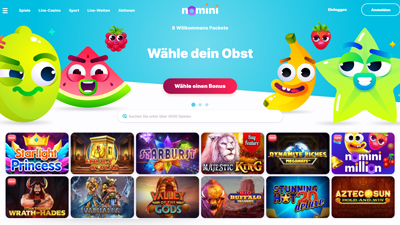

Bunt, bunter, Nomini! So könnte der erste Eindruck den die Online Spielbank Nomini bietet beschrieben werden. Die Online…

Spiele

Spiele

Hast du schon von der aufregenden neuen Gameshow namens Melody Wheel auf Yeebet Live gehört? Diese innovative Show,…

Testberichte

Testberichte

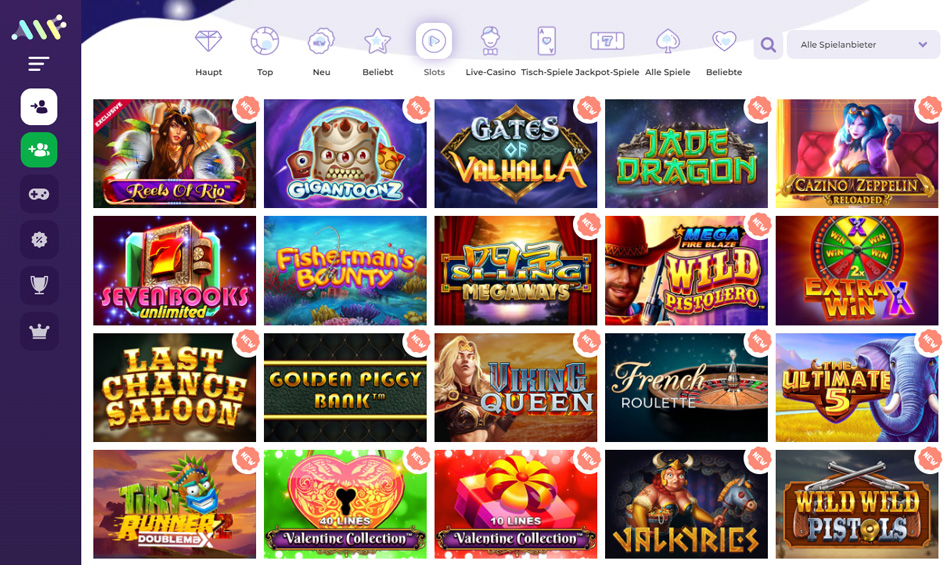

Sind Sie ein Fan von Online-Gaming und auf der Suche nach einer Plattform, die eine Vielzahl von Spielen…

Spiele

Spiele

Lotto – Ein Wort, das die Hoffnung der Menschheit in sich trägt. Kaum eine andere Freizeitaktivität entfesselt so…

Ratgeber

Ratgeber

In Österreich bedarf es einer Lizenz, um Glücksspiele anzubieten. Die Schweiz verfolgt einen eher komplizierten Ansatz, während Deutschland…

Spiele

Spiele

Free Spins für Coin Master sind die wichtigste Ressource im Spiel. Mit ihnen kannst du Münzen gewinnen, Gebäude…

Ratgeber

Ratgeber

Spielautomaten sind beliebte Glücksspielgeräte, die in Spielhallen, Casinos und Online-Plattformen zu finden sind. Sie bieten die Möglichkeit, Geld zu…

Ratgeber

Ratgeber

Spielautomaten sind beliebte Glücksspielgeräte in Casinos und Spielhallen. Sie bieten Unterhaltung und die Chance, Geldpreise zu gewinnen. In diesem Artikel werden…

Ratgeber

Ratgeber

Spielautomaten sind beliebte Glücksspielgeräte, die in Casinos, Spielhallen und Online-Plattformen zu finden sind. Sie bieten Spielern die Möglichkeit,…

Ratgeber

Ratgeber

Spielautomaten sind äußerst beliebt in Spielhallen und Online-Casinos. Doch wie sind sie eigentlich programmiert und wie funktionieren sie?…

Ratgeber

Ratgeber

Spielautomaten sind beliebte Glücksspielgeräte, die in vielen Casinos und Spielhallen zu finden sind. Sie bieten eine unterhaltsame Möglichkeit, Geld…

Ratgeber

Ratgeber

Ein Spielautomat ist eine beliebte Form des Glücksspiels, die in Casinos, Spielhallen und sogar online zu finden ist. Er…

Ratgeber

Ratgeber

Der beste Zeitpunkt, um an Spielautomaten zu spielen, ist eine Frage, die viele Spieler beschäftigt. Es gibt verschiedene…

Spiele

Spiele

Beim Raging Rex Slot von Play´n GO sind die Dinosaurier los. Ein Kometeneinschlag verändert alles und lässt die…

Spiele

Spiele

Wer sich für einen Spielautomaten mit einem gesunden Thema entscheidet, liegt bei Fruit Shop genau richtig. Dabei ist…

Testberichte

Testberichte

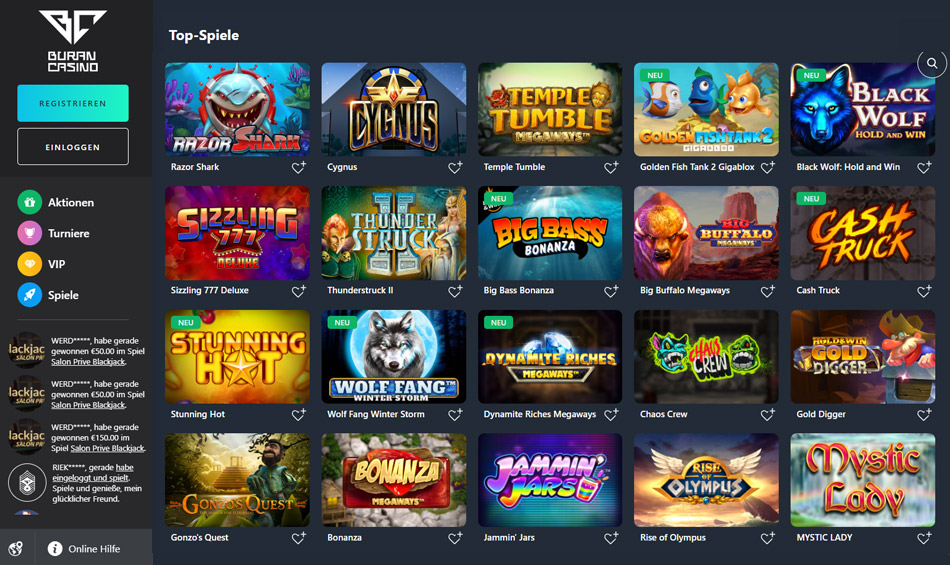

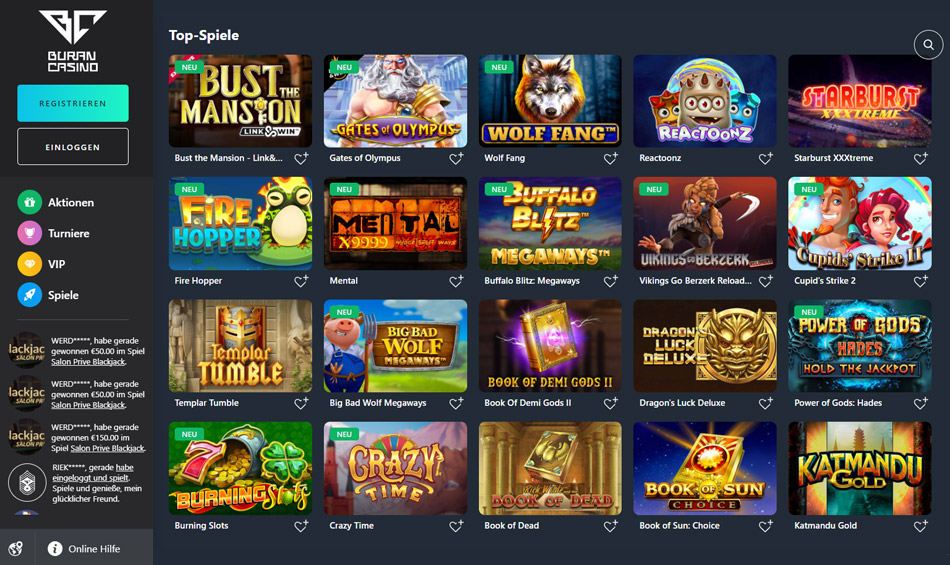

Die Welt der Online-Casinos ist ständig in Bewegung und eine der neuesten Ergänzungen auf dem deutschen Markt ist…

Spiele

Spiele

Einsteiger in die Online-Glücksspiel-Welt fühlen sich oftmals ein bisschen überfordert, denn sie sehen sich mit einem gigantischen Angebot…

Spiele

Spiele

Bei den Online-Casino-Spielen gibt es inzwischen eine Vielzahl von Themen, Bonus- und anderen Funktionen. Da fällt es gar…

Spiele

Spiele

Online-Casinos ohne Verifizierung verzichten auf den üblichen Identifizierungsprozess. Spieler müssen entsprechend keine persönlichen Daten preisgeben. Dadurch wird ein…

Spiele

Spiele

Einführung Wenn es darum geht, Casinospiele online zu spielen, sind die angebotenen Boni eines der wichtigsten Dinge, die…

Spiele

Spiele

Spielothek? Casino? Da gibt es durchaus Unterschiede. Seit kurzem dürfen sich Spielhallen nämlich eigentlich nicht mehr als Casino…

Spiele

Spiele

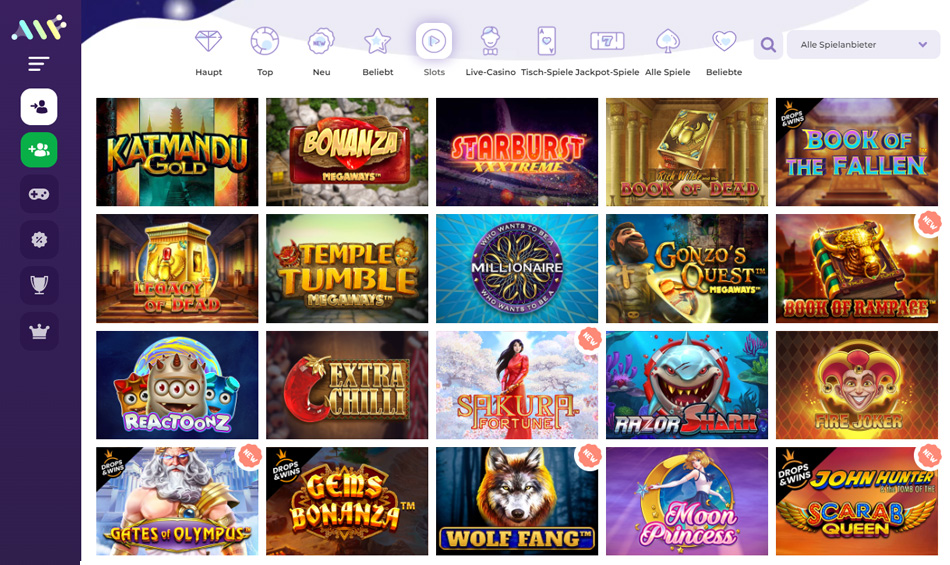

Es gibt wohl um die 5.000 Slots, von denen die beliebtesten natürlich auch von Platincasino angeboten werden. Unter…

Spiele

Spiele

Die beliebteste Sportart der Welt ist ganz klar Fußball. Wenn die Mannschaften auf dem Sportplatz aufeinandertreffen, spielt der…

Spiele

Spiele

Schon seit Jahren gehören die Fürchte-Slots zu den unangefochtenen Klassikern. Diese Slots gibt es in jedem Casino und…

Spiele

Spiele

Es gibt mehrere tausend verschiedene Slots, sodass durch die vielfältigen Angebote der Themenwelten jeder Spieler seinen Lieblingsslot findet.…

Spiele

Spiele

Book of Ra ist einer der beliebtesten Slots überhaupt. Gerade die Bücher-Freispiele mit ihrem hohen Gewinnpotenzial sind ein…

Zahlungsarten

Zahlungsarten

Um Jackpot Spielautomaten zu Fall zu bringen, um bei Book of Dead ein Vollbild zu erzielen, ist eine…

Testberichte

Testberichte

Jetzt riesen Bonus abholen, bis zu 2.500 Euro kannst du dir im Mr. Bet sichern. Die Online Spielbank…

Spiele

Spiele

Für die leidenschaftlichen Gamer gibt es keinen schöneren Zeitvertreib, als Walzen zu drehen. Da ist es gut, dass…